Property Taxes

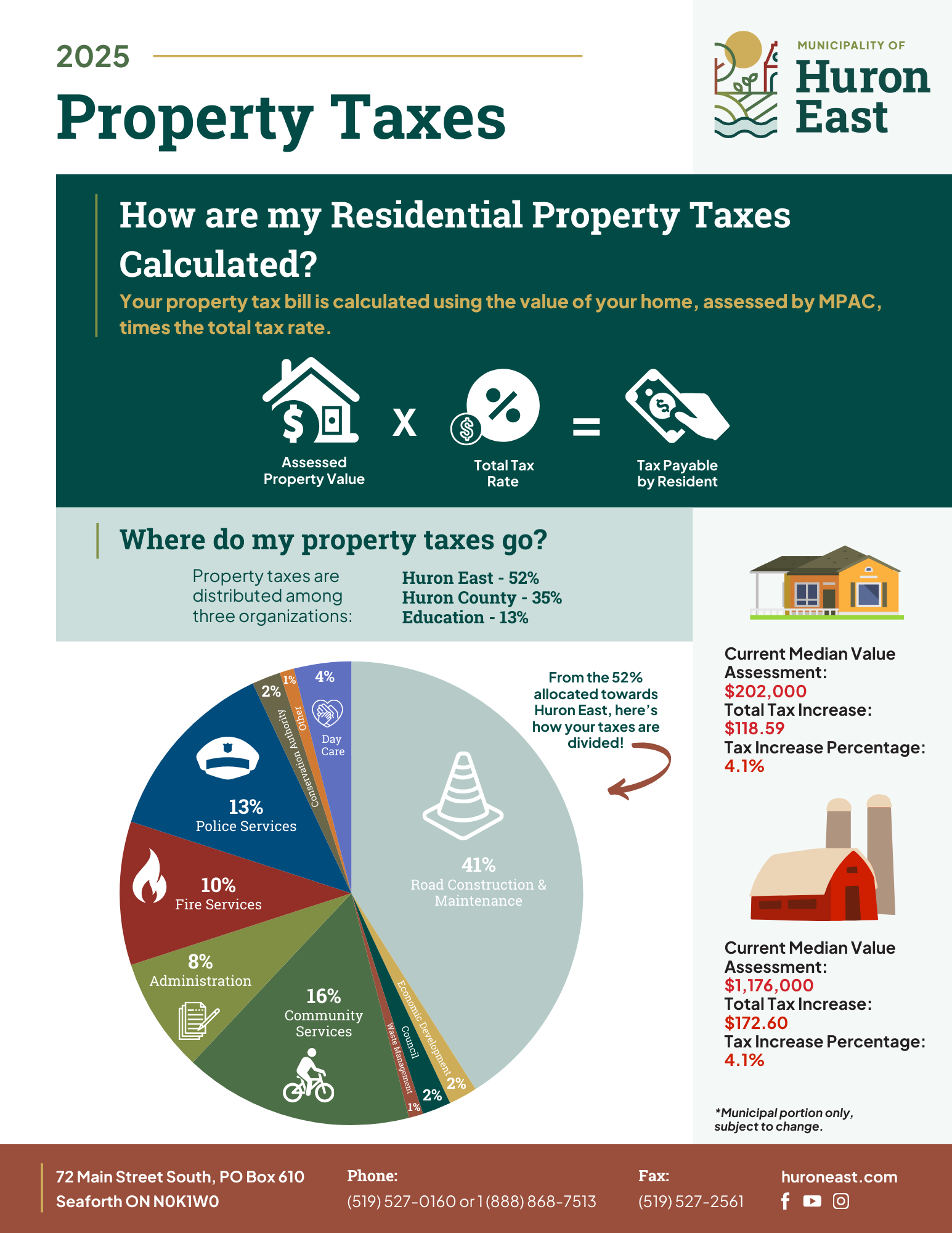

The Municipality of Huron East establishes tax rates for local municipal services and also collects taxes for the upper tier, being the County of Huron and the four local school boards.

Property taxes are used to fund the many services provided by the Municipality of Huron East.

Property Tax Bills

The Municipality of Huron East issues two (2) tax bills annually. Each billing is split into two installment due dates.

The Interim tax bills are mailed the beginning of March containing installments due the last business day of March and the last business day of June.

The Final tax bills are mailed the beginning of September containing installments due the last business day of September and last business day of November.

Note: If you have not received your tax bill or have misplaced your bill, please contact the Municipal Office at 519-527-0160 ext. 22. Failure to receive a tax bill does not excuse the property owner from paying the taxes by the installment date.

| How to Pay your Tax Bill |

The Municipality has a number of options available to our customers for payment. Payment must be received at the Municipal Office by the due date to avoid penalty.

|

| Address Change |

|

If you need to change or update your mailing address for any reason, please complete the Change of Address Online Form. Changes to your mailing address need to be made in writing. It's important that we have the most up-to-date mailing information so that you receive your tax, utility and/or invoice on time and avoid late charges. Failure to receive a tax bill does not exempt you from the payment of taxes, nor penalty and interest. |

| Enroll in E-Billing |

|

To have your tax bill emailed to you, please complete our E-Billing Enrollment Form. If you have any questions or decide to withdraw from E-Send, please contact the Municipal Office at 519-527-0160 ext. 22. Please note: It is the customer's responsibility to complete a new enrollment form if there is a change to the email address where the tax bill is being sent, and to notify the Municipal Office if your bill has not been received. Customers using the Tax E-Send service are subject to standard late fees as applicable. |

| Late Payments |

|

A penalty of 1.25% will be added on the first day of default, as well as 1.25% on the first day of each month thereafter. Penalty is deducted first from all payments made and the balance, if any, will be applied to the oldest outstanding balance first. |

| Returned Cheques |

| Cheques not honoured by your bank will result in a charge of $35.00 being added to your tax account. Please ensure your cheques are properly completed and signed. |

Are you Moving?

| Change of Ownership |

|

The Municipality of Huron East will mail a tax bill to the property owner on record when tax bills are issued. If you have recently purchased a property, your lawyer should have advised you of any taxes owing on the property. As the new owner, you are responsible for any amounts owing on the property. The statement of adjustments from your lawyers will have made allowances for the liabilities of the previous owner, call your lawyer for details. If you receive a tax bill for a property you no longer own, please contact the Municipal Office at 519-527-0160 ext. 22. |

| Property Tax, Utility, & Zoning Certificates |

| Tax, Utility, and Zoning Certificates can be requested with a fee of $80 (each) per roll number (HST exempt). Certificates will be issued once payment is received.

Rushed Tax and Zoning Certificates (same or next day) can be requested with a fee of $100 (each) per roll number (HST exempt). Click here to complete a Tax, Utility, & Zoning Certificate Online Request Form |

Property Assessment and Appeals

If you do not agree with your property assessment, you can file a Request for Reconsideration (RfR) of your assessment with the Municipal Property Assessment Corporation (MPAC). Your deadline to file an RfR with MPAC is included on your assessment notice. These forms are available on the MPAC website, at the Municipal Office or by contacting MPAC at 1-866-296-6722.

If the status of your property changes due to fire, demolition or removal of buildings, please inform us in writing by completing an Request for Reconsideration Form.

| Learn More about Property Assessment |

For more information regarding the assessed value of your property, please visit the MPAC website. |

Tax Rates

Click here to view the current Tax Rates (By-Law 038-2024)

Tax Newsletters

Each year, the Municipality of Huron East includes tax newsletters in with its tax bills. View the current tax newsletter provided to property owners here.

Tax Rebate Programs

There are a variety of property tax rebate programs that you as a property owner can apply for to reduce the amount of taxation. These rebate programs include:

| Charity Rebate |

| Registered charities may be eligible for a property tax reduction. For more information of eligibility requirements and application due dates, please contact the Municipal Office at 519-527-0160 ext. 22. |

| Farmland Property Tax |

|

As a farmland owner in Ontario, you may be eligible to apply for a property tax reduction through the Farm Property Class Tax rate Program offered by AGRICORP. Please contact AGRICORP to see if you meet the eligibility requirements. Eligible owners will need a valid Farm Business Registration number from AGRICORP in order to apply. |

| Managed Forest Tax Incentive Program |

| If you have forestland on your property, you may qualify for the Managed Forest Tax Incentive Program. More information on eligibility and qualifications of this program can be found here. |

| Conservation Land Tax Incentive Program |

| If you have a Provincially important natural heritage feature on your property, you may qualify for the Conservation Land Tax Incentive Program. More information on this program can be found here. |

Municipal Tax Sale Properties

Land can be purchased from the municipality through public tenders. The successful purchaser must pay the amount specified in the tender plus any accumulated taxes and land transfer tax.

Current properties for sale and the form of tender are also available at https://ontariotaxsales.ca/

| Tender Process |

|

Tenders must be submitted in the prescribed form. You must include a deposit of at least 20% of the tender amount, payable to the municipality (money order, bank draft, or cheque certified by a bank or trust corporation). Tenders must be submitted in a sealed envelope addressed to the Treasurer with the property description or municipal address clearly marked on the outside of the envelope. You must submit your tender by 3 p.m. local time at the Town Hall in Seaforth. Tenders are opened in public on the same date as soon as possible after 3 p.m. at the Town Hall in Seaforth on the closing date. |

| Policies |

|

Contact Us

Subscribe to this page

Subscribe to this page